Wildefalcon

Member

- Messages

- 2,580

- Location

- Gloucestershire, England

I still test mine. Hard to argue with a valid MOT cert. Plus having an experienced mechanic check your vehicle for £50 is a bargain.

Yes, previously you could make a bolt on back end and not need msva and a Q. Looks like that has gone.The requirement for type approval seems to take you back to IVA or MSVA for trikes etc….

ISTR reading that if the trike rear end is welded on it needs a msva, if it's bolt on it doesn't, but I did only have a quick spin through it.Yes, previously you could make a bolt on back end and not need msva and a Q. Looks like that has gone.

I've seen plenty of "specialists" that are useless, and lots of home builders that do amazing work. All it means is that everything that's done has to be safe, no matter who does it.This could limit diy

"Modifications should only be done by a specialist. You’re responsible for making sure your vehicle is always"

Following the links in the adviceYes, previously you could make a bolt on back end and not need msva and a Q. Looks like that has gone.

From inf318 guidance notesThis could limit diy

"Modifications should only be done by a specialist. You’re responsible for making sure your vehicle is always"

I cant disagree with that at all….especially in the bike world!I've seen plenty of "specialists" that are useless, and lots of home builders that do amazing work. All it means is that everything that's done has to be safe, no matter who does it.

The grey area will be the kit….buy a couple of hub carriers and wishbones from mr kit car, and you are in business. Having said that, if you are building something properly passing the MSVA shouldn't be an issue. The word drawings is mentioned…I did wonder if you had drawings for the parts if you could build the kit yourself!Following the links in the advice

"

*Motorcycle to tricycle modification

Where a motorcycle to tricycle conversion has been carried out using a conversion kit or plans, these will be assessed in accordance with the kit-conversion guidance. See the section on kit-conversions."

So we go to the kit conversion advice.

"You can apply to keep a kit converted vehicle’s original registration number if you can prove you’ve used 2 original major parts along with the original unmodified:

The next section is for frame mods and requires MSVA and gets you an age related plate or a Q

- chassis (car or light van)

- monocoque bodyshell (car or light van)

- frame (motorbike)"

one would hope so, but not always the case……..its that how do you demonstrate competency question again!From inf318 guidance notes

"This work should only be carried out by a person with the relevant engineering knowledge to carry out a modification safely."

I would hope that would be the case if you are modifying a chassis.

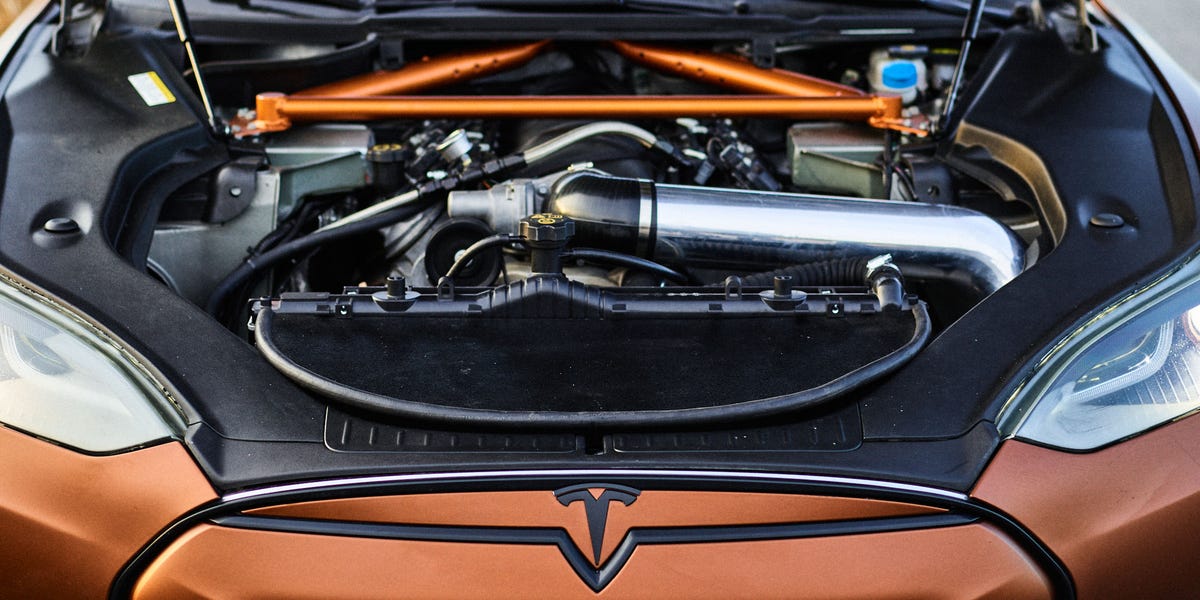

So does that mean a nice V8 into say a Tesla remains zero emissions?Late reply as i needed abit of time to see what stuck out in all of this. As were all looking at modified ICE stuff probably missed the end of this cracker ....

**Vehicles converted to electric propulsion Converting a vehicle with an internal combustion engine to electric propulsion must only be undertaken by a specialist with the electrical engineering knowledge necessary to carry out a conversion safely.The process of converting a vehicle from an internal combustion engine to electric propulsion is considered a modification. This is because it requires the engine and transmission to be removed and significant modifications to key vehicle control systems, including braking and steering assistance, as well as changes to accommodate an electric motor and battery pack.There is a legal requirement to notify DVLA of a change of fuel type as this may affect the information shown on theV5C. This must include full details of the modifications thathave been done to the vehicle as part of the conversionto electric. The MOT requirements (over or under 40 yearsold) are also applicable for electric conversions.Where the law allows, DVLA will amend the fuel type and tax class to electric.

Cars and light goods vehicles first registered on or after1 March 2001 are taxed according to the CO2 emissionfigure. When a vehicle has been converted to electric propulsion, the law requires DVLA to retain the CO2emissions figure recorded at first registration. This means the vehicle must remain in a CO2 based tax class and cannot be moved into the electric tax class.

This could limit diy

"Modifications should only be done by a specialist. You’re responsible for making sure your vehicle is always"

Amazing isn’t it? How clear it all becomes when you actually quote the entire paragraph, and not just a few choice words from it.Late reply as i needed abit of time to see what stuck out in all of this. As were all looking at modified ICE stuff probably missed the end of this cracker ....

**Vehicles converted to electric propulsion Converting a vehicle with an internal combustion engine to electric propulsion must only be undertaken by a specialist with the electrical engineering knowledge necessary to carry out a conversion safely.The process of converting a vehicle from an internal combustion engine to electric propulsion is considered a modification. This is because it requires the engine and transmission to be removed and significant modifications to key vehicle control systems, including braking and steering assistance, as well as changes to accommodate an electric motor and battery pack.There is a legal requirement to notify DVLA of a change of fuel type as this may affect the information shown on theV5C. This must include full details of the modifications thathave been done to the vehicle as part of the conversionto electric. The MOT requirements (over or under 40 yearsold) are also applicable for electric conversions.Where the law allows, DVLA will amend the fuel type and tax class to electric.

Cars and light goods vehicles first registered on or after1 March 2001 are taxed according to the CO2 emissionfigure. When a vehicle has been converted to electric propulsion, the law requires DVLA to retain the CO2emissions figure recorded at first registration. This means the vehicle must remain in a CO2 based tax class and cannot be moved into the electric tax class.