It's not always about taking a loan out or a new credit card it can be simple things like paying for insurance with installments or paying a gas or electricity bill.

But to be honest I find it so wrong a private company can set up and first of all get personal information on you. But even worse supply it to others.

Not only that but they all have differing credit indicators a few of which make no sense.

I am reading that correctly am I not??

I also thought that changes are being brought in where you no longer get a free 30 plus days to clear all the card to zero. I.e they charge you from the day you purchase an item??

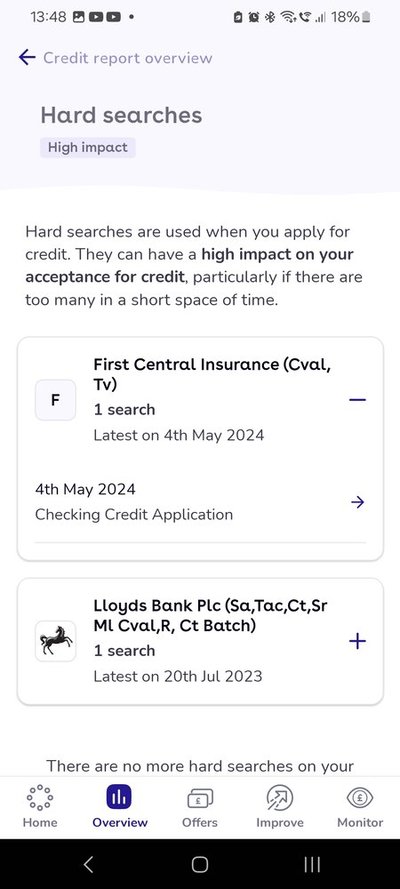

I lost 11 points just because of 2 hard searches. Car insurance and I assume my bank for the same thing??

In case anyone is unaware the reason you need a good credit score ( assuming you need credit, is because the interest rate they charge varies according to your credit score, which often makes no sense.

Is it just me or do others think or feel the same?

EDIT: I just noticed the one search is from 2023. I made an application for a further advance to pay for the lease on our house. It was actually accepted and funds were paid out....but as they sent it to the wrong place, and issues with length of current lease, it was sent back.

But the hard search stays on my account and affects my credit score.

This just can't be right, can it?

But to be honest I find it so wrong a private company can set up and first of all get personal information on you. But even worse supply it to others.

Not only that but they all have differing credit indicators a few of which make no sense.

I am reading that correctly am I not??

I also thought that changes are being brought in where you no longer get a free 30 plus days to clear all the card to zero. I.e they charge you from the day you purchase an item??

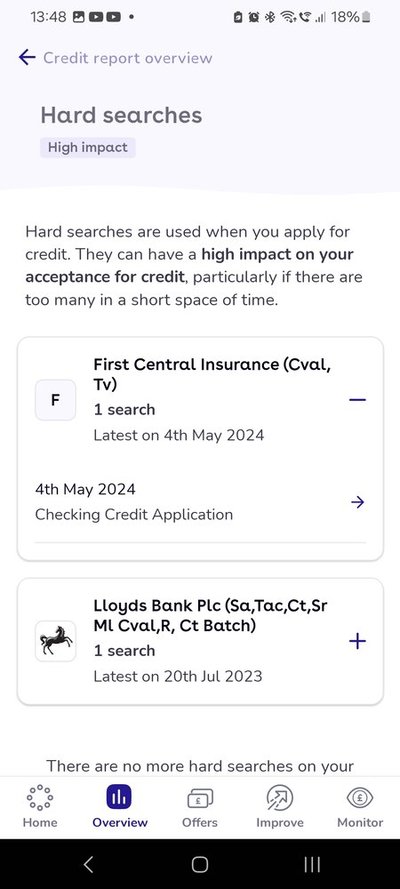

I lost 11 points just because of 2 hard searches. Car insurance and I assume my bank for the same thing??

In case anyone is unaware the reason you need a good credit score ( assuming you need credit, is because the interest rate they charge varies according to your credit score, which often makes no sense.

Is it just me or do others think or feel the same?

EDIT: I just noticed the one search is from 2023. I made an application for a further advance to pay for the lease on our house. It was actually accepted and funds were paid out....but as they sent it to the wrong place, and issues with length of current lease, it was sent back.

But the hard search stays on my account and affects my credit score.

This just can't be right, can it?