You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tax Returns

- Thread starter johnakay

- Start date

Paul.

Moderator

- Messages

- 7,047

- Location

- Northampton. UK

In that case dont worry about it, you will get a letter in April 2011, asking for a tax return to be filled in and returned, by either October 31st, 2011 on paper, or Jan 31st, 2012 online.I only became self employed this year..june..

so what now?I was on the dole during 09 and part of 010. so am I ok ?

Paul.

Moderator

- Messages

- 7,047

- Location

- Northampton. UK

They wont send you a form unless you ask for it, they really want everyone to use the online service, I've been doing it for years and it works really well, you have to register on the inland revenue website, then they will send you a password by post to activate your account services, its worth doing it now even if you don't need to use it yet, then when you do get the demand you can either use the online version on the site for free, or there are commercial versions approved by hmrc, my favorite is Taxcalc Its about £25 for the personal version, that includes self employment, but will do up to 6 forms, and is really easy to use, does all the calculations for you, and even tells you if you've missed anything out,

W4yne

Member

- Messages

- 289

just been informed by a guy on another forum that the tax return form etc

has been brought forward from Jan to nove this year.

can any one confirm this as I'm self employed and this is my 1st year. john

I had until October to fill out mine, or January if filling it out online, I have not been informed of any change.

johnakay

Member

- Messages

- 1,801

believe or not I got a reminder to fill on line.

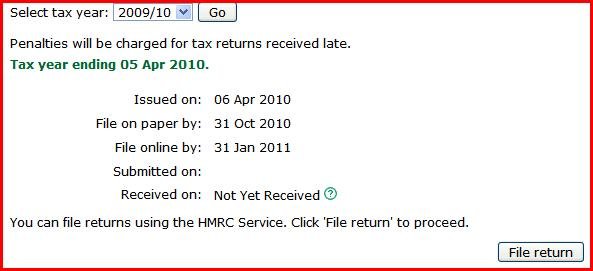

rang them up but they insist that I should fill in on line due to me getting a pension. a measly £435 a year. only got under 5 grand for the year 2009/2010.jsa money etc. didn't start working till may 2010.

got a letter saying that I no longer need to fill on line.

but I will still have to as my circumstances have change since2009(working).

so I'll have to go through that rigmarole again.

wouldn't be so bad but last time I had to wait 40 minutes before some one answered

rang them up but they insist that I should fill in on line due to me getting a pension. a measly £435 a year. only got under 5 grand for the year 2009/2010.jsa money etc. didn't start working till may 2010.

got a letter saying that I no longer need to fill on line.

but I will still have to as my circumstances have change since2009(working).

so I'll have to go through that rigmarole again.

wouldn't be so bad but last time I had to wait 40 minutes before some one answered

brightspark

Member

- Messages

- 41,587

- Location

- yarm stockton on tees

there the shi ,.../s took me 20 mins to get a reply last weekbelieve or not I got a reminder to fill on line.

rang them up but they insist that I should fill in on line due to me getting a pension. a measly £435 a year. only got under 5 grand for the year 2009/2010.jsa money etc. didn't start working till may 2010.

got a letter saying that I no longer need to fill on line.

but I will still have to as my circumstances have change since2009(working).

so I'll have to go through that rigmarole again.

wouldn't be so bad but last time I had to wait 40 minutes before some one answered

bloody telephone companys must be rubbing there hands

bloody telephone companys must be rubbing there hands